New Facts To Picking Boliglånskalkulator

Wiki Article

What Information Should I Consider Prior To Submitting An Application For Personal Loans?

Before making a final decision regarding a consumer loan product, it's important to consider and evaluate a few key elements.-

Flexible repayment plan - Consider the flexibility of your repayment plan. Certain lenders permit you to alter your repayment schedule or pay early without penalty. Charges and FeesBe aware of any additional charges or fees that come along with the loan, such as the origination fee or late payment fees or early repayment fees.

Reviews and Reputation - Read reviews and research the lender to determine their credibility. Consider the lender's responsiveness, customer service, and honesty.

Financial Situation and Budgeting- Review your budget and financial situation to ensure you can comfortably pay your monthly bills without strain. Borrow only the amount you are able to pay.

Explore your choices and options. Compare loans from various sources to determine which one best meets your requirements.

Consider comparing options and assessing how the loan fits within your financial plans and goals prior to committing to one. To make an informed choice consult with experts or financial advisors if are uncertain. Check out the most popular Forbrukslå for website info including refinansiere kredittgjeld, lån oppussing, bolig låns rente, bolig låns rente, refinansiering av gjeld, beste rente forbrukslån, forbrukslån med betalingsanmerkning, refinansiere gjeld, forbrukslån refinansiering, søk om boliglån and more.

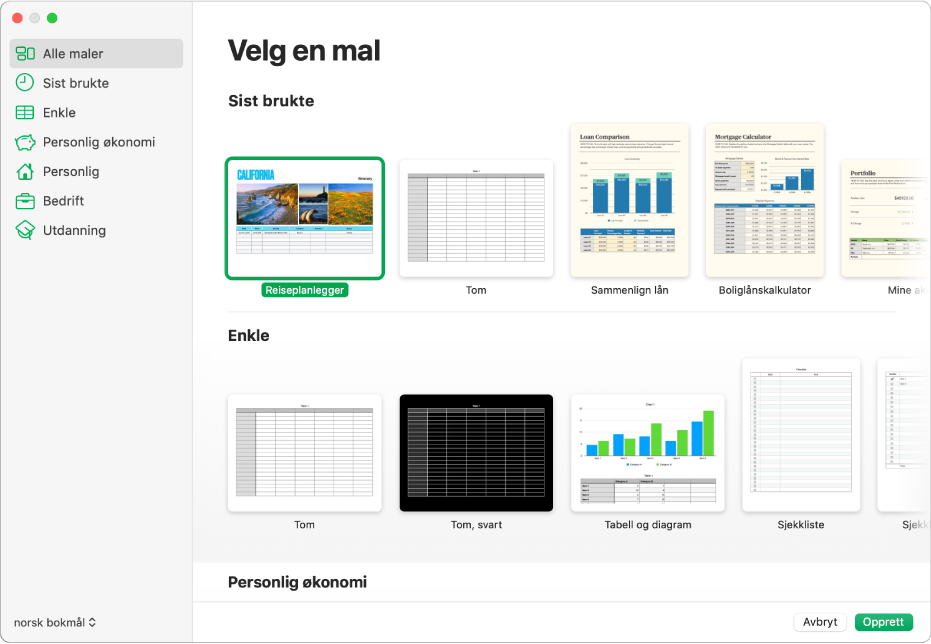

What Exactly Is A Mortgage Calculator? How Precise And Effective Is This Tool?

It's a tool that helps individuals plan their housing expenses and assess affordability. It helps homeowners estimate their home expenses and evaluate their affordability. Be aware of these elements:

Estimation of monthly mortgage payments - Mortgage calculators calculate estimates of monthly payments based on input information. In addition to principal and interests some calculators take into account property taxes, homeowners’ insurance, or private mortgage insurance.

Accuracy of Information: The accuracy of the calculator depends on the accuracy and completeness of input information. The calculated results could be inaccurate if provide incorrect information, like the loan amount or interest rate.

Limitation of Scope The mortgage calculators offer an estimate. They don't account for all financial details or other factors that change over time, including tax rates, interest rates and insurance, for example.

Education Tool - These tools can be used to educate users by allowing them to try out various scenarios. Users can adjust variables so they are aware of how changes in loan terms or down payment affect monthly costs and overall costs.

Mortgage calculators offer a comparison tool that allows customers to examine different types of loans in terms, terms, or payment amounts. This allows you to make an informed decision on the best mortgage options.

Consultation with professionals- Although mortgage calculators provide helpful estimates, contacting financial advisors, mortgage brokers or lenders is suggested to gain a better knowledge of the loan options, qualifying requirements, and particular financial conditions.

Mortgage calculators can be an excellent starting point for making estimates of mortgage payments as well as looking at different scenarios. Financial experts are recommended to provide precise, personal information about mortgage terms and approvals. View the top Boliglånskalkulator for more examples including forbrukslån med lav rente, flytte lån, lån rente, kortsiktige lån, lån til oppussing, raske lån, forbrukslån lav rente, forbrukslån med sikkerhet i bolig, refinansiere med sikkerhet i bolig, bank norge and more.

What Is An Refinance Mortgage? And What Are The Requirements To Be Met?

Refinance mortgages are new loan designed to replace a previous mortgage. Most people refinance their mortgages for different reasons. They may wish to lower the rate of interest, decrease monthly payments, or modify the loan terms. To get approval for a home refinance, several factors must be taken into consideration. To assess your creditworthiness, lenders evaluate your credit score. Credit scores that are better typically translate into higher rates and terms for loans.

Income and Employment Verification - Lenders will confirm your income and employment history to make sure you can pay back the loan.

Home Equity. The equity you have in your property is an important aspect to consider. To be able to get lenders to approve refinancing, usually they require a minimum amount equity. The equity is determined by comparing a house's current value with the mortgage balance.

Loan-to-Value (LTV) Ratio- LTV ratio is the percentage of the value of your home which you're borrowing. The lenders are more interested in low LTVs, generally less than 80%. They are less risky.

Appraisal- A property appraisal is typically required to determine the present market value of a home. Lenders will use it to evaluate the value of the property to the amount of loan.

Debt to Income (DTI) ratio Lenders evaluate your DTI by comparing your monthly payments of your debts with your gross monthly earnings. A lower DTI ratio demonstrates your ability to manage additional debt.

Documentation- Prepare the required documentation such as pay stubs or tax returns. Also, prepare bank statements and other financial records. This is essential as lenders may require these documents to assess your financial status.

Reasons for refinancing - Be sure to clearly specify the motive behind the refinance, whether it's to reduce monthly payments, changing the loan's terms and consolidating debt or accessing equity.

While lenders may have their own standards and requirements, achieving them doesn't ensure approval. Check out offers and compare to find the most favorable conditions. Additionally, understanding the costs associated with refinancing, like fees and closing costs is vital in evaluating the total benefits of a refinance. Follow the top rated Refinansiere Boliglån for more advice including refinansiere med betalingsanmerkning, lån forbrukslån, refinansiere kredittkort, forbrukslån med sikkerhet i bolig, lån uten sikkerhet med betalingsanmerkning, lånekalkulator boliglån, din bank, nominell rente, søk om boliglån, refinansiering av gjeld med betalingsanmerkning and more.